What is the difference between a CFO and a CPA (tax accountant)?

A CFO plays a much bigger role in the broad business aspects than does a tax accountant. While CPAs typically spend 90% of their time on tax strategy and only 10% on business strategy, the opposite is true for CFOs. We are entirely focused on your company’s business strategy and delivering value. CFOs spend their time on revenue strategies, financial forecasting, profitability enhancement and cash flow optimization, while an accountant is often immersed in transactional accounting, closing the books, preparing financial statements and taxes. As a member of your management team, our CFOs will monitor your company’s day-to-day financial operations and contribute to a wide variety of financial and operational projects and initiatives.

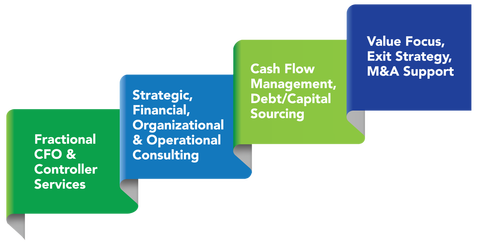

We serve as your company’s financial leader (CFO) and key business partner. In addition to providing oversight of your company’s broad financial planning process and the management of all aspects of your firm’s financial infrastructure and operations, our CFOs will communicate to both internal team members and external stakeholders. Designed specifically to achieve your goals and objectives, our services can be customized to include:

- Oversight and development of the financial function (personnel, processes, accuracy, timeliness, best practices)

- Cash flow planning and working capital management, including interactive forecasting, monitoring and treasury optimization

- Capital structure design and implementation, to include identification of type and amount of capital components (debt or equity) and related terms and conditions

- Business planning through interactive financial modeling

- Overall financial plan, including integration with company’s strategic and operational roadmap

- Financial and operational improvements

- Performance metric identification, implementation and reporting (value drivers)

- Exit planning, strategy and preparation, including oversight of appropriate valuation processes

- Transactional due diligence support (acquisitions, divestitures, exit, operating agreements, etc. from a financial perspective